Alberta’s population boom is expected to decelerate in 2025 while oil could sink below US$70

Two powerful engines have helped Alberta’s economy lift off in the past two years: exceptional population growth and strong oil prices.

What happens if both start to sputter at the same time?

“If we’re in the mid-70s, it’s certainly a different question. If we’re in the sub-70s, it (a deficit) is very likely,” Nate Horner told reporters Thursday.

The government forecasts Alberta’s gross domestic product will expand by three per cent this year and 2.7 per cent in 2025. That’s below the province’s 3.3 per cent projection made in February’s budget.

Finance officials also trimmed Alberta’s oil price outlook to US$74 a barrel, down $2.50 from the first quarter.

Prices for West Texas Intermediate (WTI) crude have been hovering around $70 a barrel over the past month, dipping this fall due to increased uncertainty about growing non-OPEC supply and uncertain global demand. (Benchmark U.S. oil prices increased more than $1 on Friday to close at $71.24 a barrel.)

“Clearly, our growth rate will be much lower” in 2025, Alberta Central chief economist Charles St-Arnaud said Friday.

“We still have a positive tailwind from the population. It’s not as big as it’s been over the past few years, but it’s still there. Oil is a bit more uncertain.”

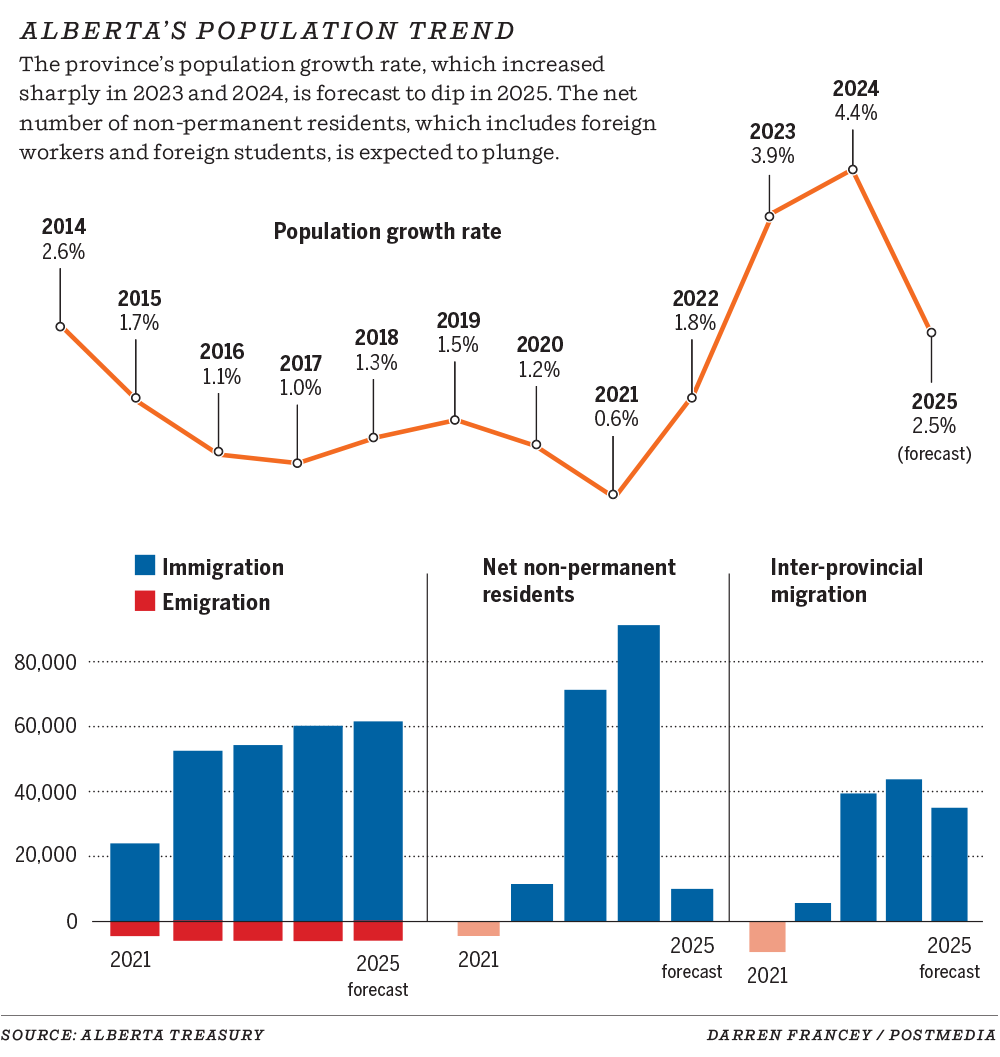

Since the pandemic began to recede in 2022, Alberta has seen a sharp increase in newcomers from other provinces and outside the country.

The trend has spurred economic expansion, increasing retail sales — which are down on a per-person basis from pre-pandemic levels, but up overall with a growing population — and housing construction. It’s also put pressure on rent prices and infrastructure.

St-Arnaud calculates the province’s stellar population growth last year was responsible for a full percentage point of Alberta’s GDP growth of 2.3 per cent.

In the 2023 census year (ending July 31), the province’s population grew by 173,000, or 3.9 per cent.

This year, it increased by 4.4 per cent, as non-permanent residents, including foreign students and temporary foreign workers, topped 91,000 and interprovincial migration jumped above 43,000.

Fewer non-permanent residents are forecast to come to Canada after a change in federal policy, while the Trudeau government recently cut its target for new permanent residents for the next three years to under 400,000 people, down from half-a-million newcomers.

According to Alberta Finance data, the province’s population will top five million for the first time in 2025, but the annual rate of growth is expected to slow to 2.5 per cent. (The report projects Alberta will still add almost 120,000 new residents — more than the population of Lethbridge — in the 2025 census year.)

The biggest projected decrease is from non-permanent residents falling to 10,000, nearly a 90 per cent drop from 2024 levels. And that figure is expected to turn into a net outflow in 2026.

The province has welcomed more than 400,000 people in the past three years; a slowdown will allow the housing market to catch up, said Horner.

“I think moderating and then decreasing the population growth is a good thing,” Horner said.

“It will have impacts to the economy. But it will also provide a lot of relief to individual Albertans and to the public pressures that we’re facing. So, I’m not too worried — 4.4 per cent is unsustainable.”

Slower population growth will affect consumer spending levels, but falling interest rates are expected to support the economy and consumers next year, said ATB Financial chief economist Mark Parsons.

“We are not going to get the same boost that we’ve had in the last two years from the consumer, coming from population growth,” he said.

“We do expect the unemployment rate to edge lower from current levels, mostly because of slower population growth.”

On the energy front, Scotiabank is forecasting WTI crude prices next year will average $66 a barrel, while the U.S. Energy Information Administration is projecting $71.60, down from $77 this year.

The cartel has looked to bring some spare production back online, but it could add to an oversupplied market.

A lot of next year’s outlook will depend on oil demand growth in China, and if incoming U.S. President Donald Trump makes good on his pledge to impose a 60 per cent tariff on the country’s imports, said Josephine Mills with energy analytics firm Enverus.

“I think it (WTI crude below $70-a-barrel) is a very real possibility if not only China is tariffed, but other countries have tariffs as well,” she said.

“That has a huge impact on our demand view.”

Chris Varcoe is a Calgary Herald columnist.