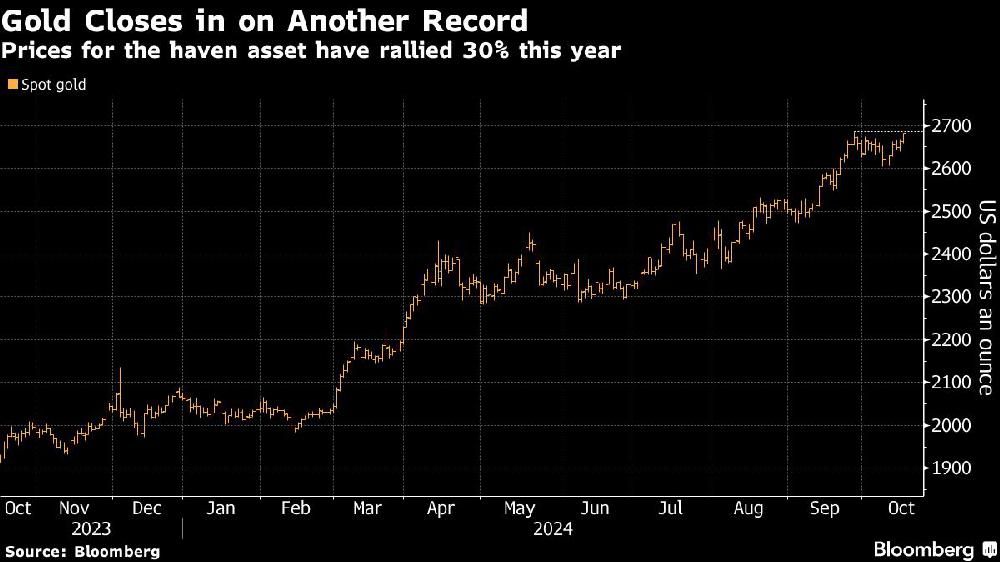

Gold rallied toward a fresh record high as investors turned their attention to the upcoming U.S. election

The precious metal is one of the strongest performing commodities in 2024, setting successive records thanks to its appeal as a safe haven asset and rapacious central-bank buying. Now, it’s finding fresh support as investors across financial markets reposition their portfolios in response to uncertainty over the outcome of the U.S. presidential race.

“We anticipate uncertainty and volatility to rise until the next U.S. administration is settled,” UBS Group AG analysts led by Mark Haefele, the bank’s global wealth management chief investment officer, said in an emailed note. They advised that “gold and oil can be effective portfolio hedges” in a volatile trading environment.

Over the past year, elevated Fed rates have done little to slow gold’s breakneck ascent to consecutive record highs, and for now many investors are betting that the pivot to looser monetary policy — and an accompanying slowdown in U.S. economic growth — will help fuel further gains.

Gold is expected to climb to record highs over the next year, according to a survey of the bullion industry at a major annual gathering. Delegates at the London Bullion Market Association event in Miami expect the precious metal to rise to US$2,917.40 an ounce by late October next year, about 10 per cent above current levels.

Spot gold was 0.6 per cent higher at US$2,679.21 an ounce as of 11:05 a.m. in London, nearing the record of US$2,685.58 set last month. Prices are up about 30 per cent so far this year.

All precious metals were higher, with silver pacing gains with a 1.3 per cent rise. The Bloomberg Dollar Spot Index was steady near a two-month high.