Tellurian is a cautionary tale for amateur traders hoping to outsmart Wall Street

For Bjorn Bos and other retail investors who piled into energy company Tellurian Inc. in the past few years, it wasn’t meant to end this way.

The message resonated with investors such as Bos, who lives in the Netherlands. Before the acquisition, retail buyers owned about 40 per cent of Tellurian.

“The allure of Souki really attracted most of us,” he said. “I am still really beat up by this news. We lost a really big amount of savings.”

The lesson for Bos was a harsh one: “Never, ever, invest with money you cannot afford to lose.”

A Tellurian spokesperson declined to comment, while Souki didn’t immediately respond to requests for comment by phone and text.

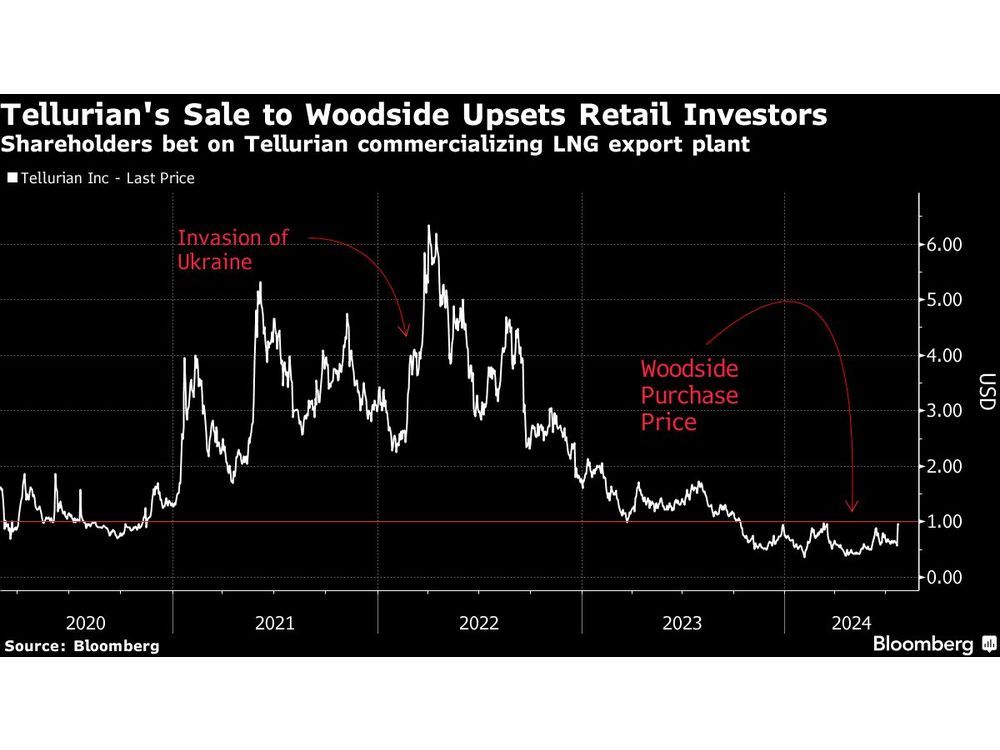

Woodside’s deal to buy Tellurian for US$900 million is set to close in the fourth quarter and will likely be approved by passive institutional investors, who control the majority of its stock. But that’s little comfort to the retail buyers.

All of the more than 10 individual investors interviewed by Bloomberg, some with losses as high as US$1 million from Tellurian, were unhappy with the outcome. Many are offloading their shares, with trading volumes hitting a record on Monday.

Souki, once one of the highest-paid CEOs in the United States, was a relentless pitchman for Tellurian. Aside from denouncing short sellers, he also tried to convince amateur traders that Tellurian offered a pure investment play for a fuel that would play a critical role in the transition to cleaner energy.

But while Souki is a larger-than-life figure, he’s also a controversial one. After founding Cheniere Energy Inc. nearly three decades ago and remaking it from an LNG importer into the first exporter of U.S. shale gas, he was ousted from the company in 2015 amid a push from billionaire investor Carl Icahn, who accused Souki of overspending. Three months later, he set up Tellurian with Martin Houston, another industry veteran.

Despite the impressive pedigree of its leadership, Tellurian struggled to make progress on its LNG project, known as Driftwood. The pandemic cut demand for gas, and a deal with a potential Indian customer fell through, helping to drive its shares lower in 2020 and making it a target for short sellers.

It was around this time that retail investors began to take notice. The stock was cheap, and the community of shareholders quickly grew, creating a Discord channel and a Reddit board to swap research. And Tellurian’s share price began to recover.

Souki not only noticed this budding community, but also leaned into it, posting videos on YouTube to directly speak with these investors while at the same time bashing the short sellers.

“The management was a huge part of it for me,” said Ryan Panno, who began investing near the end of 2020. “They had two co-founders that had started a successful company.”

The stock rode higher after Russia’s invasion of Ukraine in early 2022 sent gas prices surging. Europe weaned itself from Russian pipeline gas, with U.S. LNG replacing some of that supply. Tellurian’s stock price, at a time when Driftwood remained just a concept, soared above US$6.

But the company was unable to convince banks to lend them the billions of dollars required to make a final investment, while other rivals moved ahead with expansions or new projects. The stock gains evaporated, and Souki was ousted in December.

Tellurian’s remaining management will be awarded bonuses with the successful sale to Woodside, an amendment that was approved during the annual meeting in June, while retail investors are left grappling with losses. But for the top executives, the payouts agreed upon with the acquisition are down 70 per cent versus what they would have received if Tellurian had made a final investment decision on Driftwood.

“It’s the Tellurian board’s responsibility to communicate with their shareholders about the merits of the deal,” Meg O’Neill, Woodside’s chief executive, said earlier this week.

O’Neill said she would welcome shareholders to “invest in Woodside as a way to get the upside that they were hoping to receive by investing in Tellurian.”

That’s exactly what Panno did.

“I bought some Woodside today,” he said on Monday, after selling 80 per cent of his Tellurian holdings. “I think they’re getting a steal.”