‘The average household is paying more for energy than it did in the past, and it affects everyone’

Are high energy prices good for Alberta?

For frustrated consumers at the gasoline pumps or business owners opening their utility bills, it might seem like a straightforward question with an obvious answer: high energy expenses sting.

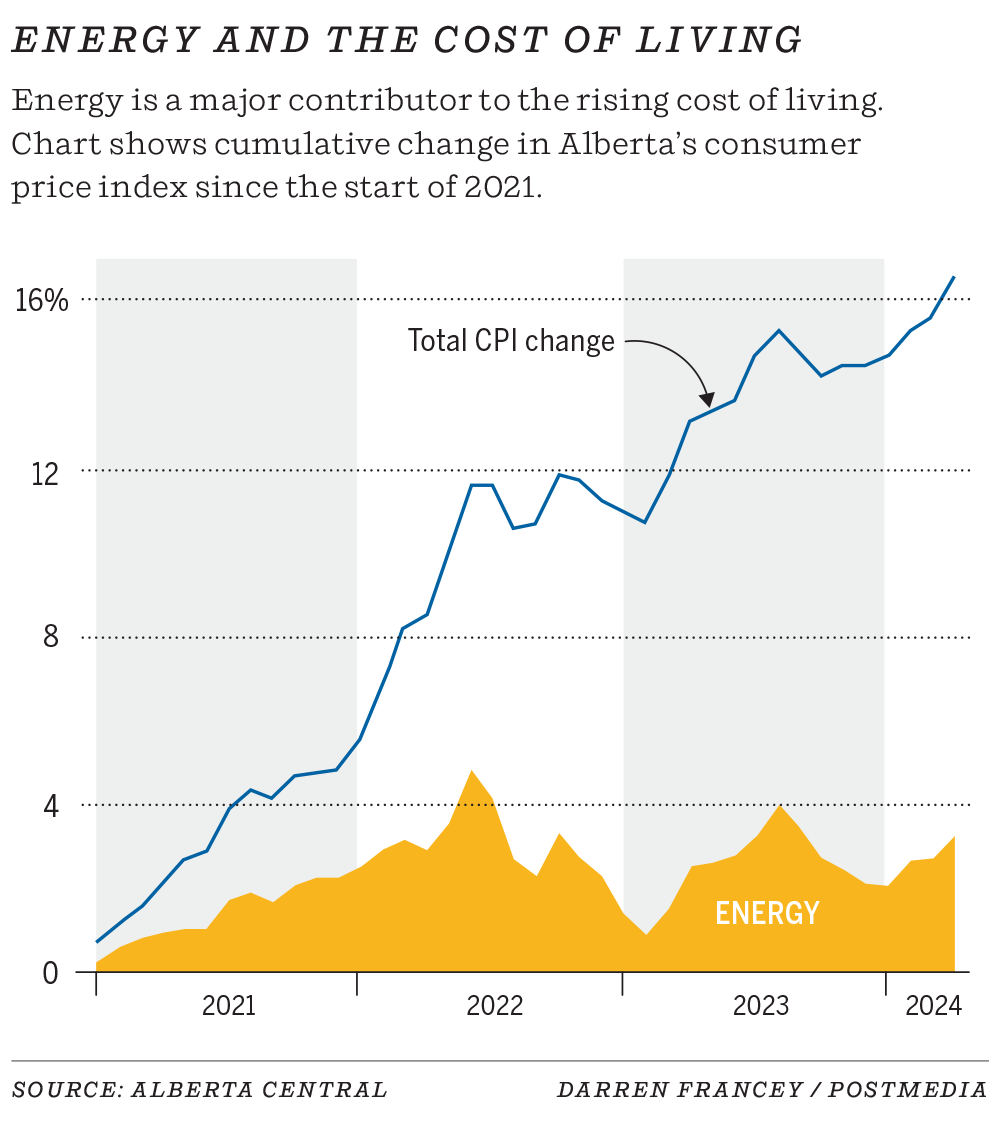

After electricity bills soared to record levels last year and gasoline prices edged above $1.50 a litre this summer, energy costs have become a pinch point in an inflationary vice.

“It is a double-edged sword,” says Lisa Watts, co-owner of Hub Town Brewing in Okotoks, who used to work in the energy industry as a chemical engineer.

“We understand that $100-a-barrel oil translates into more jobs and a more bustling economy, and that bustling economy means more money in people’s pockets. And hopefully, that trickles down to us.

“Unfortunately, we’re at such a brutal time now with inflation and the cost of doing business, we haven’t seen that yet.”

Energy remains lifeblood of Alberta’s economy

In Alberta today, higher energy prices are seen by many as a mixed blessing. Increasing prices for oil or gas benefit the sector and the provincial government, yet aren’t so welcomed by consumers.

“When you’re standing at the pumps and looking at $80 to fill your tank, it’s tough to take,” says Susan Bell, senior vice-president of downstream at Rystad Energy in Calgary and an expert in the refining and marketing business.

“I can understand people being disgruntled about high pump prices, even though it means higher revenues for the oil companies, it does mean more royalties, it could mean more government spending on social services.”

Energy remains the lifeblood of Alberta’s economy and high prices bolster industry revenues and investment.

Last year, non-renewable resources generated more than $19 billion for government coffers, or more than $4,000 for every person living in Alberta.

Oil, gas and mining made up 18.4 per cent of the province’s gross domestic product (GDP) in 2023. And the industry directly employed 147,000 Albertans in June, with 19,000 more people working in the sector than a year earlier, according to Careers in Energy.

Other industries also benefit when oil and gas producers do well, such as engineering firms designing big projects, skilled tradespeople working on plant maintenance, or hotel and restaurant operators across the province where drilling crews are active.

‘Oil prices don’t have the same torque on the Alberta economy’

Energy also makes up about three-quarters of our exports, says Mark Parsons, chief economist at ATB Financial and previously an assistant deputy minister with Alberta Finance.

However, since the oil price crash of 2014, the sector’s impact has shifted somewhat as petroleum producers reinvest a smaller portion of their revenues in the province, he notes.

“We are a net energy exporter, so what higher oil and gas prices do is improve…our terms of trades, it improves our incomes, so it’s still a net positive,” says Parsons.

“That being said, oil prices don’t have the same torque on the Alberta economy as they used to. Oil and gas investment is roughly half what it used to be in 2014. That limits the upside, but also the downside.”

Indeed, oil, gas and mining powered 27 per cent of Alberta’s GDP a decade ago. In 2005, it made up nearly one-third of the economy.

Estimates by the ARC Energy Research Institute indicate petroleum producers in Canada will reinvest about half of their after-tax cash flow this year, or $41 billion.

Yet, that ratio exceeded 100 per cent back in 2015, when the industry spent $55 billion, borrowing and issuing equity while investing heavily in additional exploration and production.

The percentage of foreign shareholders in the largest oilsands producers has also increased, meaning more revenue exits the province through increased investor returns, says Alberta Central chief economist Charles St-Arnaud.

High royalty rates benefit government’s bottom line

However, with stronger global crude prices, more oilsands projects have shifted into paying a higher royalty rate to the province, bolstering the government’s bottom line.

That’s double the figure from the 2019-20 budget year.

If a rising tide lifts all boats, the energy sector still creates big waves in Alberta.

This year, more than $17 billion of resource revenue is expected to flow to provincial coffers, 24 per cent of all government revenues.

Put another way, that’s enough money to cover the government’s combined budget for the social services and education ministries.

Energy price volatility also saw the province swing from a record $16.9-billion deficit in 2021-22, to a mammoth $11.6-billion surplus just two years later.

That whipsaw occurred after WTI crude careened from averaging less than US$40 a barrel during the first year of the pandemic to more than US$100 a barrel two years later.

Former finance minister Travis Toews says he used to check benchmark oil prices daily — and sometimes even hourly — during tumultuous times, given their importance to the treasury.

Today, higher energy prices help the province generate wealth across the province, with economic spinoffs and increased productivity, he says.

“There’s no doubt that every Albertan benefits either directly or indirectly from higher energy prices,” Toews says, who left politics last year and is a senior fellow at the C.D. Howe Institute.

“There is the credit column, they do benefit. But then there’s the expense column and we also all pay more. Of course, the benefit and the cost are disproportionately allocated amongst Albertans. And so for some, these higher energy prices are extremely hard. And for others, their opportunity exceeds their increased cost…

“And that’s going to be a reality and hence, therefore, (a) tension.”

‘The average household is paying more for energy’

What about the average Albertan who isn’t directly connected to the energy industry?

Regular unleaded gasoline prices in the province averaged less than $1.40 a litre a year ago, but topped $1.53 a litre late last week, according to GasBuddy.

“The average household is paying more for energy than it did in the past, and it affects everyone,” St-Arnaud says.

“I still believe that higher oil prices are a net positive. But it depends on which side (you’re on) — it’s not as vastly positive as it used to be.”

It’s not just oil going up — natural gas prices are in a funk this year, it should be noted — but also the impact of expensive electricity that has jolted consumers recently.

Power prices skyrocketed in the past three years and once provincial rebates came off, higher electricity bills sparked rising inflation, before prices began to ease.

A survey of 450 business operators by the Alberta Chambers of Commerce last fall found 71 per cent were very concerned about electricity costs, and half were concerned with their gas utility costs.

Doug Bartole, a lifelong Albertan and CEO of junior petroleum producer InPlay Oil Corp., says the rise in electricity prices means it’s now become one of the top four or five largest expenses at the company.

“Honestly, I am frustrated with my power bill specifically…In the same light, we do like higher natural gas prices and we like higher oil prices,” says Bartole.

“But I always tell people and investors that I don’t like $100, $120 oil…What I do get concerned about is it going to $120 and gasoline going to $2.50 a litre because then that causes demand destruction, which in turn causes $80 or $90 oil going to $60 oil — and here we go again.”

Finding the oil price sweet spot

Author and energy economist Peter Tertzakian, a member of the province’s last royalty review in 2015, believes there is a sweet spot where higher oil prices are most beneficial to the province, likely in the range of $65 to $75 a barrel.

Beyond that, it fuels inflation and calls for policy intervention, such as demands for Ottawa to impose windfall taxes on the industry.

“If you get much beyond $80 a barrel…you get a whole bunch of negative effects,” Tertzakian says.

Watts, who owns Hub Town Brewing with her husband, says that negative effects have already hit.

The surging costs for electricity and gas pounded their bottom line, with utility expenses rising from about $1,200 a month when they began operating the business five years ago to about $5,000 to $6,000 today.

“When they say higher energy costs are good for the economy, I can assume that someone in the economy is benefitting, but from the small business perspective and from the general public, I’d say it is tough,” she says.

“It probably is, but we don’t have a direct benefit from it. It’s indirect and we don’t know for sure until we see people starting to walk through the door and spend more when they’re with us.”

Chris Varcoe is a Calgary Herald columnist.

This week: The Cost of Doing Business

Read more from the series:

- ‘This is a homeless shelter!?’: A single mother’s journey through homelessness in Calgary

- ‘The business of generating yield for shareholders’: Why rents are going up so fast in Calgary

- ‘It’s depressing being a 40-year-old stuck at home’: Why the dream of homeownership is fading for many Calgarians

- Dream home or one-bedroom condo? What will $700,000 buy you in housing markets across Canada

- Rising rents: what $2,000 a month will get you in major Canadian cities right now