Paladin Energy’s planned Toronto listing is part of an effort to secure approval for its with Fission Uranium

The last large foreign mining company to list on the TSX was Chile’s Aclara Resources Inc., which did an IPO in December 2022. Before that, Australia’s Newcrest Mining Ltd. dual listed from the Australian Securities Exchange in October 2020.

“It’s a really big win for us to be able to add this company to our listings,” said Dean McPherson, global head of mining and business development for TSX and TSX Venture.

McPherson travelled to Perth to pitch Paladin on the strengths of the TSX’s access to capital for miners. He plans another trip to Australia in October to drum up interest from other Aussie miners.

“There are some other significant energy stories out there, particularly in the uranium space that are not yet listed,” he said.

U.S. miners and other ASX-listed companies should follow Paladin to Toronto, he said: “We’re gonna make that argument.”

McPherson said he had also pitched Kazakhstan’s state-owned uranium miner National Atomic Co. Kazatomprom on pursuing a listing in Toronto. The company, which trades in Almaty and London, did not reply to a request for comment in time for publication.

Paladin chief executive Ian Purdy said the Toronto listing will give shareholders an option beyond Cameco Corp., the world’s largest publicly traded uranium producer. His company has production in Namibia as well as a potential growth project through the Fission deal.

“We think there’s an opportunity to provide an option to Cameco,” he said. “Who else is there in Canada that you can invest in that’s got production and growth? We’d like to be the second option and the TSX will give us access to all of those retail shareholders.”

Paladin’s base of institutional shareholders has doubled since the company began producing the nuclear fuel in Namibia, Purdy said. He expects growth from the Fission deal as well as the expanded shareholder base in Toronto to send his firm’s A$3.6-billion (US$2.4-billion) market capitalization to more than US$5 billion.

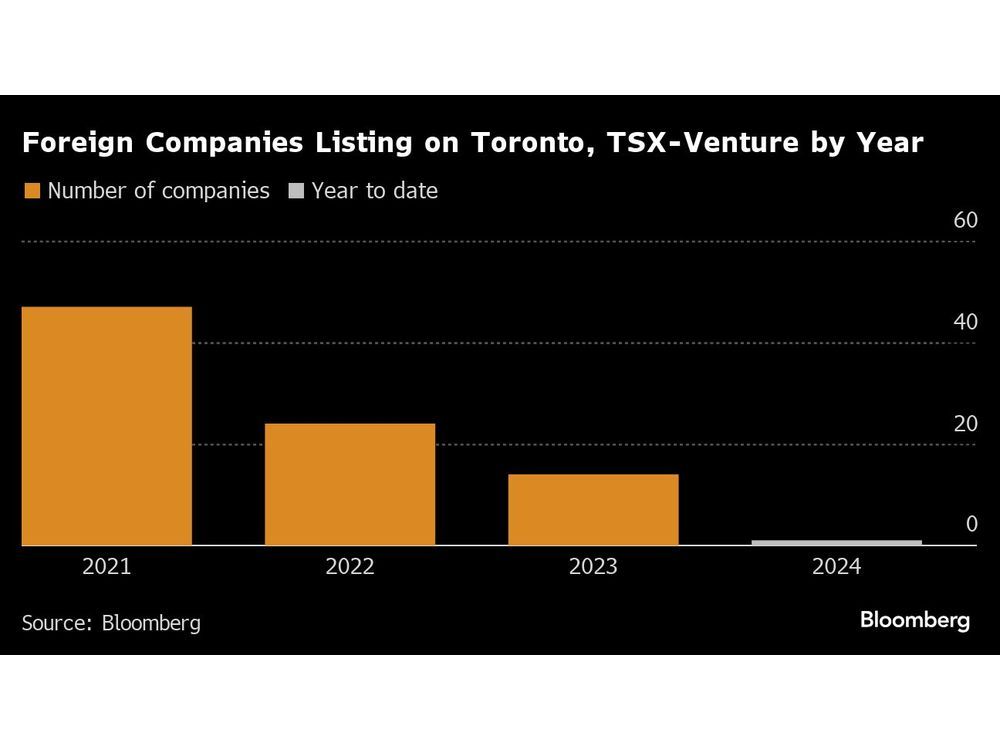

Indeed, Paladin’s listing would mark just the second foreign company to list on either the TSX or TSX Venture Exchange this year, down sharply from the 14 new listings in 2023 and 24 in 2022. Australia’s AuMega Metals Ltd., a small-cap, dual listed on the TSX-Venture in June.

McPherson said the Paladin listing, combined with an uptick in financing activity by mining and metals companies, is helping him pitch other companies on listing in Toronto.

“It’s good to see the market making a rebound,” he said.

With assistance from Jacob Lorinc